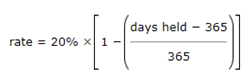

British Columbia Introduces the Flipping Tax—What is it and Why Should You be Aware?What is the Flipping Tax and Why is it Important?The B.C. government announced in its 2024 budget a plan to introduce a tax (the Flipping Tax) on income earned from the sale of a property within 730 days of acquisition. The Flipping Tax, subject to legislative approval, will be imposed under the Residential Property (Short-Term Holding) Profit Tax Act scheduled to take effect January 1, 2025.1 The B.C. government estimates that the Flipping Tax will generate $43M of tax revenue in its first year.2 The Flipping Tax forms part of the Province's broader initiative under British Columbia's Homes for People plan to provide affordable housing by: (1) fast-tracking home availability; (2) delivering better, more affordable homes; (3) helping those with the greatest housing need; and (4) creating a housing market for people, not investors.3 The Flipping Tax aims to reduce competition between purchasers seeking a home for their personal use and investors looking to turn a quick profit. Note that the Flipping Tax is separate and distinct from the federal property flipping rules, which operate under a 365-day window for sale.4 How Will the Flipping Tax be Imposed?The Flipping Tax will apply to net taxable income from the sale of taxable property within 730 days of acquisition.5 A taxable property means a beneficial interest, or the right to acquire a beneficial interest, in residential property.6 Net taxable income is calculated by subtracting acquisition and renovation costs from the sale proceeds of the property, less the primary residence deduction, as explained below.7 Generally, a taxable property is acquired on the purchase date.8 When a party exercises their right to purchase a property that includes a housing unit under, or proposed for, development, the property is acquired on the date the party received the purchase right.9 Where a property is acquired from a related person, the property is acquired on the date the related person acquired the property. However, if there is a series of acquisitions of a taxable property from related persons, the property is acquired when the first party in the series acquired it. Related persons include, in part, related individuals, a corporation and the person(s) controlling the corporation, two corporations if they are controlled by the same person(s) or one owns the other, and a new and predecessor corporation.10 A taxable property is disposed of on the date it is sold in exchange for consideration.11 The disposal date is: (1) the day consideration is due or received; or (2) if consideration is paid in installments, the day the first installment is due or received.12 The applicable tax rate will vary on a declining basis depending on when a property is bought and sold, or a contract is entered into and then assigned. A 20% tax rate will apply to net taxable income earned from the sale of a property or an assignment of a contract within 365 days after it was purchased, and then gradually decreasing to 0% until day 730.13 If the taxpayer held the property for more than 365 days, the tax rate is determined by the following formula:

The primary residence deduction provides property owners with a taxable income deduction up to $20,000 if: (1) the property owner owns14 the property for at least 365 consecutive days before the sale, and (2) the property includes a housing unit that is used as the property owner’s primary residence. Primary residence is defined as “the place in which an individual resides longer than any other place during the period”.15 This deduction is not available when a presale contract is assigned (see below for more information on presale contracts). If an owner sells a portion of their interest, the primary residence deduction will be proportionally reduced. What Properties will be Subject to the Flipping Tax?The Province has stated that the Flipping Tax will apply to taxable properties sold (or contracts assigned) after January 1, 2025, including those purchased after January 1, 2023.16 It is expected that the Flipping Tax will apply to affected properties irrespective of the property owner’s residency.17 The Flipping Tax will apply to the sale of properties with a housing unit, properties zoned for residential use and the sale of the rights to acquire such properties such as the assignment of a purchase contract.18 Exemptions from the Flipping Tax include those based on a property's location, the selling entity, and life circumstances.19 The Flipping Tax is not expected to apply to income earned from the sale of property located on reserve lands, treaty lands, and lands of self-governing Indigenous Nations.20 Many entities are exempt including, in part:

Life circumstance exemptions are expected to be available for home buyers forced to sell their property within the 730-day timeframe for reasons unrelated to turning a profit. Specifically, the exemptions are expected to include the sale of a property due to:22

Related party transactions, residential properties used exclusively for commercial use, and building activity on land without a housing unit are also slated to be exempt. Additional exemptions are anticipated for owners engaged in real estate development, or who otherwise positively contribute to housing availability in British Columbia, as this aligns with the Flipping Tax’s aim of supporting the Province's housing supply.24 Builders and developers are proposed to be exempt from a taxable transaction if a person, including related person(s): (1) is in the business of buying and selling properties to construct or place buildings, and holds properties for that purpose; and (2) the taxable property was held by the person to construct or place a building.25 There are also proposed exemptions anticipated for the construction of housing units on residential properties.26 A person would be exempt from a taxable transaction if: (1) building activity occurred to construct or place a housing unit on the property during the period the person held the property; and (2) the property did not include a housing unit when it was acquired. Building activity includes clearing or excavating the site, constructing or placing the housing unit, and any other necessary activity to construct or place a housing unit. Qualifying renovations and the construction of additional housing units are also expected to be exempt.27 How will the Flipping Tax be Enforced?28Property owners subject to the Flipping Tax must file a tax return within 90 days of the taxable transaction unless they qualify for an exemption, or the commissioner has extended their filing window.29 Failing to comply may result in penalties equal to:30 the greater of $500 or 5% of the unpaid tax on the transaction; plus the amount determined by the following formula: amount = 1% x A x B where: Will the Flipping Tax Apply to Presale Contracts?31For presale properties, the Flipping Tax is anticipated to apply to properties sold within 730 days of the date the presale contract is signed, even if the property itself is not actually acquired. For example, if a purchaser signs a pre-sale contract on May 1, 2022, and completes the purchase of the property upon completion on May 1, 2024, any subsequent sale of the property would not be subject to the Flipping Tax as the 730-day window would close on May 1, 2024.32 The Province clarified in a subsequent amendment to its originally published information that the 730-day window will not reset on completion of the purchase; that is, a pre‑sale purchase that completes on a pre‑sale contract will not be subject to a second Flipping Tax on completion of the purchase. However, if a purchaser assigns its rights under a presale contract, then the assignee’s 730-day window will commence on the effective date of the assignment. If an assignment is made within the 730-day window, any income made by the assignor will be subject to the Flipping Tax. Notably, a property owner cannot qualify for the primary residence deduction if they assign a presale contract. Next StepsThe Flipping Tax may undergo updates as the Residential Property (Short-Term Holding) Profit Tax Act progresses towards expected legislative approval by 2025. However, at this time, homeowners or real estate investors expecting to gain income from selling properties held for less than 730 days should be cognizant of the timelines set out above and structure their transactions accordingly. If you have any questions, please reach out to the authors of this blog or a member of our Vancouver Commercial Real Estate group. 1 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 110. 2 Simon Little, "B.C. Budget 2024: New house-flipping tax, help for first-time homebuyers" (22 February, 2024), online: <https://globalnews.ca/news/10311381/bc-budget-house-flipping-tax/> 3 Government of British Columbia, Ministry of Housing, Homes for People (British Columbia: MOH, 2023) at online: <https://news.gov.bc.ca/files/Homes4People.pdf> 4 Government of Canada, “Residential Property Flipping Rule” (last modified 27 March, 2023), online: <https://www.canada.ca/en/revenue-agency/programs/about-canada-revenue-agency-cra/federal-government-budgets/residential-property-flipping-rule.html> 5 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 8. 6 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 1. 7 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 11. 8 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 4; Government of British Columbia, "BC Home Flipping Tax" (last modified 9 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax#exemptions> 9 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 4. 10 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 6. 11 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 1 and 4. 12 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 4. 13 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 9. 14 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 12. 15 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 1. 16 Government of British Columbia, "BC Home Flipping Tax" (last modified 9 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax#exemptions>; C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 7. 17 Government of British Columbia, "BC Home Flipping Tax" (last modified 9 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax#exemptions> 18 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 1. 19 Government of British Columbia, "Exemptions from BC home flipping tax" (last modified 3 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax/exemptions#life-circumstance-exemptions>; C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), Part 3. 20 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 18. 21 Government of British Columbia, "Exemptions from BC home flipping tax" (last modified 3 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax/exemptions#life-circumstance-exemptions> 22 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 25. 23 Government of British Columbia, "Exemptions from BC home flipping tax" (last modified 3 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax/exemptions#life-circumstance-exemptions> 24 Government of British Columbia, "BC Home Flipping Tax" (last modified 22 February, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax#exemptions> 25 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 22. 26 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 21. 27 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 23. 28 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), Part 4. 29 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 41. 30 C-15, 2024: Budget Measures Implementation (Residential Property (Short-Term Holding) Profit Tax) Act, 2024, 5th Sess, 42nd Parl, 2024 (first reading), s. 48. 31 Urban Development Institute, "Provincial - Budget 2024 Flipping Tax Details" (28 February, 2024), online: <https://udi.org/blog/provincial-budget-2024-flipping-tax-details#article-top> 32 Government of British Columbia, "BC Home Flipping Tax" (last modified 9 April, 2024), online: <https://www2.gov.bc.ca/gov/content/taxes/income-taxes/bc-home-flipping-tax#exemptions> Authors

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs. For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com. |

Blog