Canada's M&A Landscape Q3 2024: Creativity in Canadian Deal Making

October 10, 2024

Written By Kevin Myson and Kimberley Grellinger

The third quarter of 2024 saw big deals, some encouraging trends and lower interest rates in Canada's M&A market. Dealmakers continue to show their creativity to bridge the valuation gap between buyers and sellers. We look at these developments in this latest edition of Bennett Jones' quarterly M&A update—as well as the growing role and importance of representations and warranties insurance (RWI) in Canadian M&A transactions.

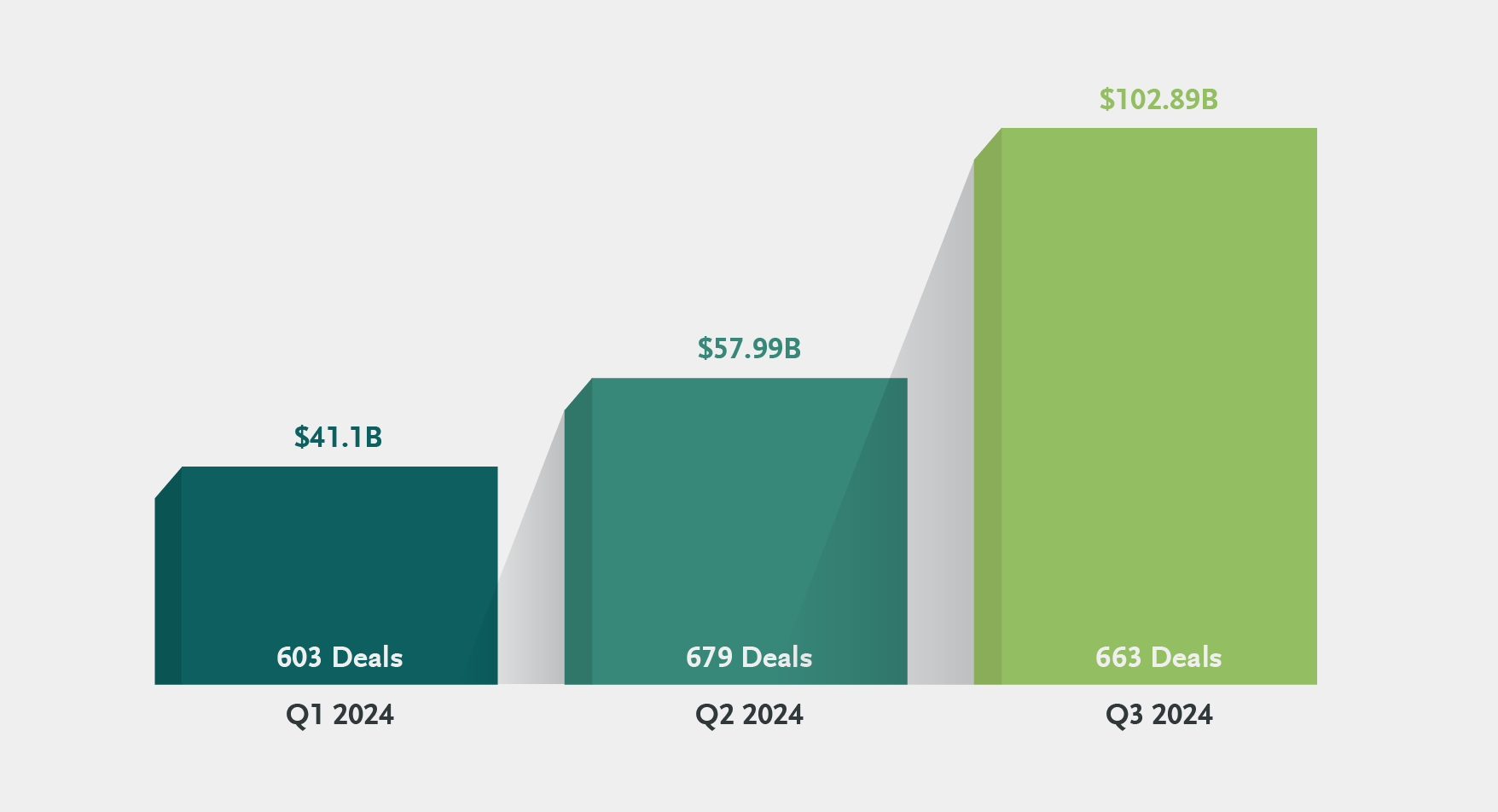

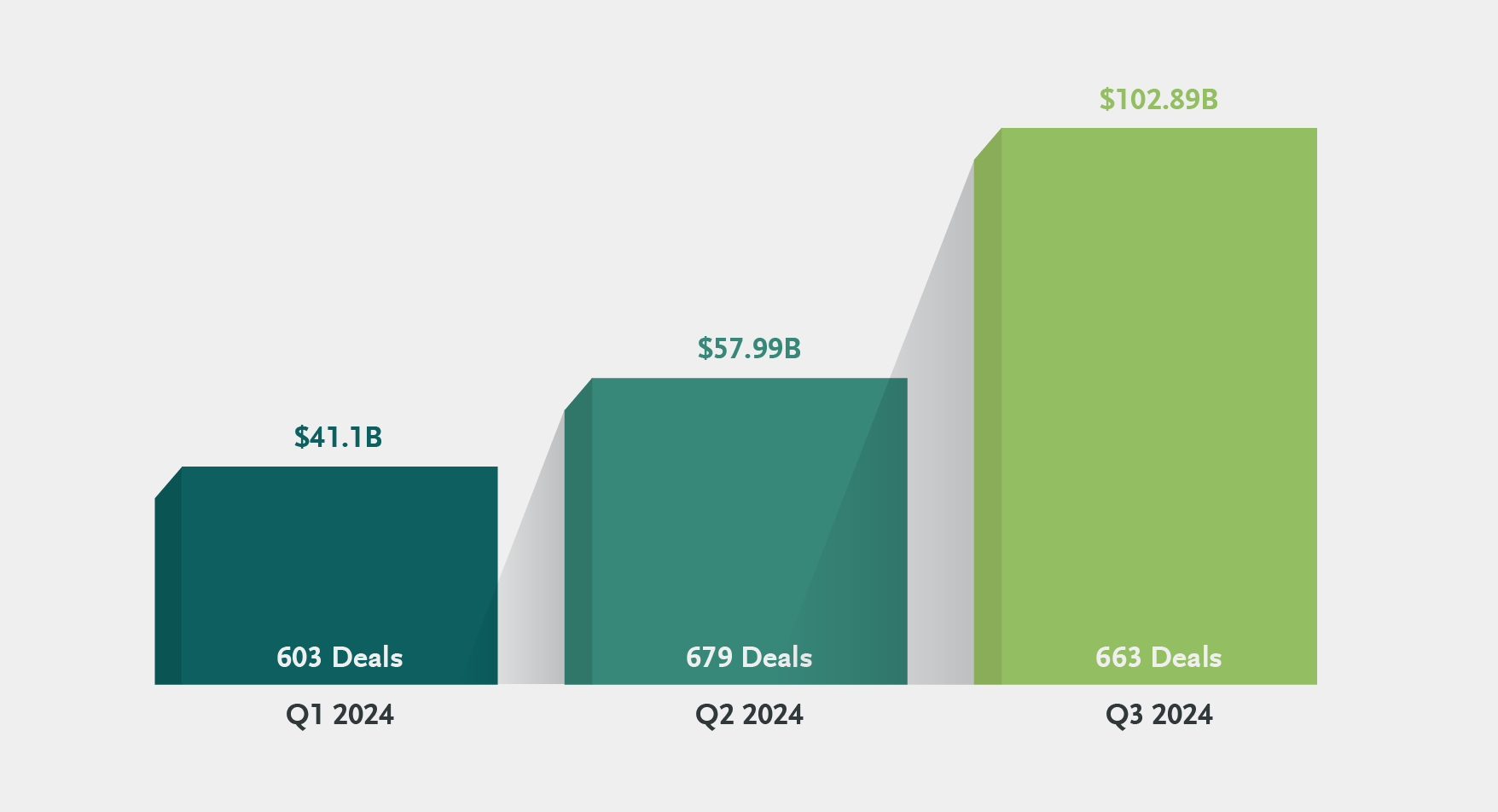

M&A Activity Q3 2024

All numbers are according to Bloomberg data in U.S. dollars unless otherwise stated (announced, completed or pending deals—excluding those that have been terminated or withdrawn—where a Canadian company is the acquirer, target or seller) as of September 30, 2024.

Bolstered by the two largest announced transactions of the year with a Canadian component, Q3 2024 took M&A deal volume in Canada to heights it has not seen in almost three years. This is the first time that the aggregate value of deals has grown for two consecutive quarters—and the first time it exceeds $100 billion in one quarter—since Q4 2021.

Canadian M&A Deal Activity

The biggest deal of the year by far was announced in Q3 in the food sector—Couche Tard's $39 billion proposed acquisition of Japan's Seven & i Holdings.

The second largest deal in 2024 was also announced this quarter, with CPP Investments and Blackstone's pending acquisition of Australia’s AirTrunk in a $16.1-billion telecommunications transaction.

The mining sector had the third highest dollar volume in Q3 with $6.47 billion on 138 deals. There were 20 deals in the oil and gas sector in the third quarter—the same number as the first two quarters of the year combined. Dollar volume was $2.17 billion in Q3, less than half of the $5 billion total in Q1.

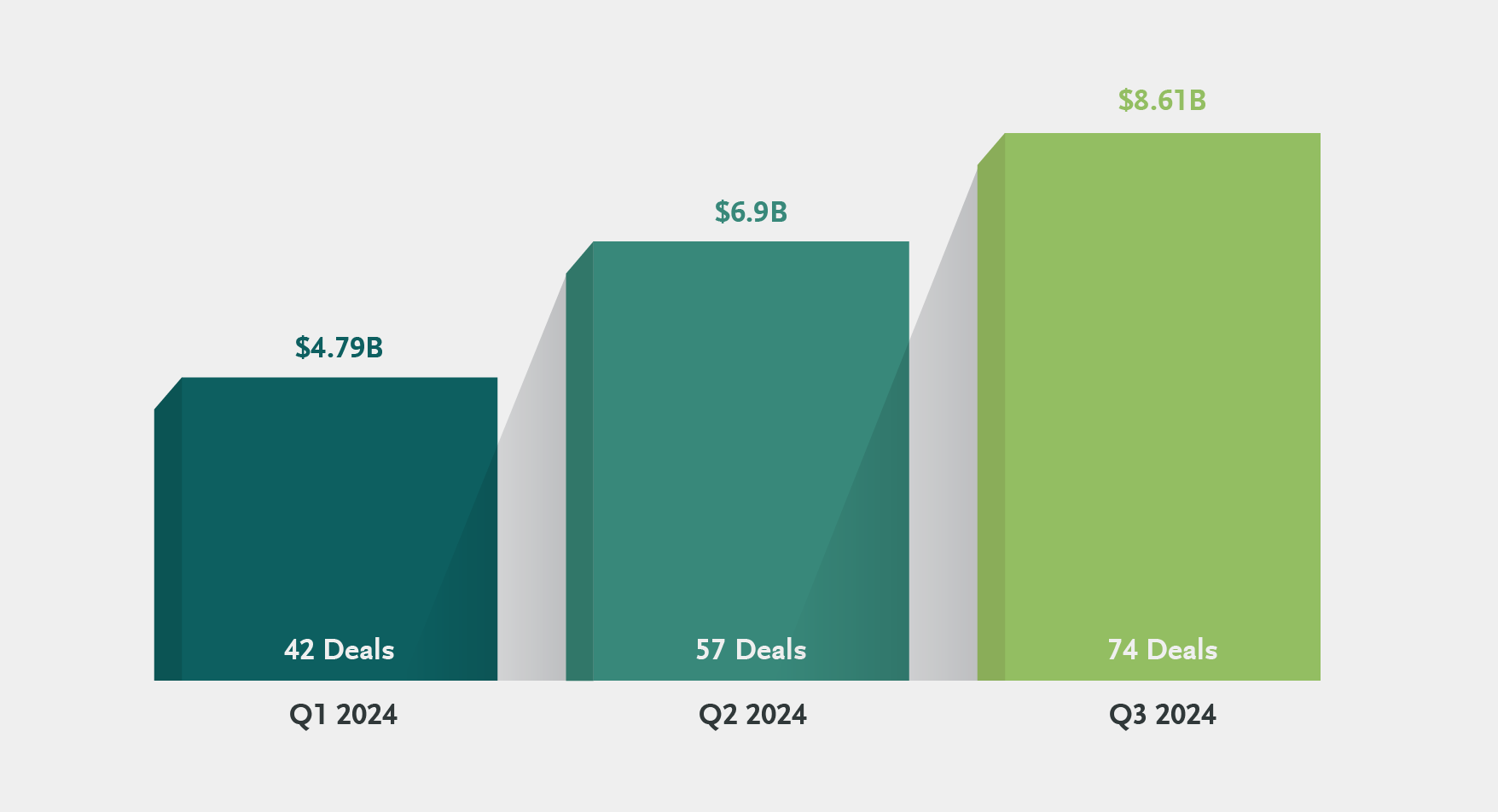

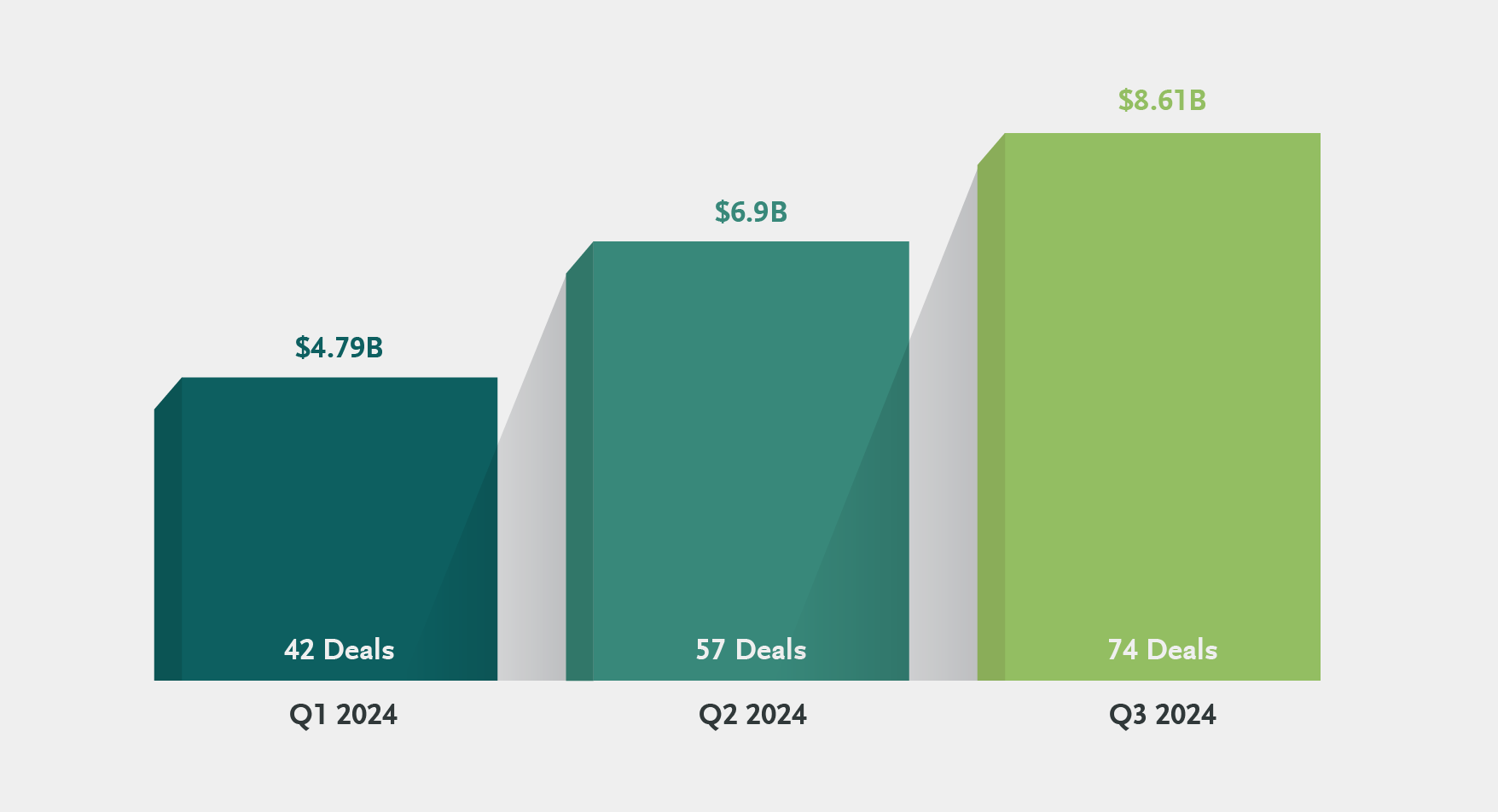

Mid-Market M&A

M&A activity was up in the mid-market once again in Q3 2024 in both dollar value and deal count.

Mid-Market Deal Activity

$20M to <$500M

Interest Rates and Inflation

The third quarter of 2024 brought welcome news on interest rates from both the U.S. Federal Reserve and the Bank of Canada.

On September 18, the Fed cut its key interest rate by a half a percentage point. This lowered the target range for the federal funds rate to a range of 4.75 to 5 percent. This is the central bank's first easing cycle in four years and it signaled at further reductions ahead. The annual rate of inflation in the United States fell to 2.5 percent in August 2024.

The Bank of Canada cut its key interest rate on September 4 for a third consecutive time, reducing its policy rate by 25 basis points to 4.25 percent. Additional cuts are expected.

Canada’s annual inflation rate rose by 2 percent in August. This is the first time since February 2021 that inflation has returned to within the Bank of Canada’s 2 percent target.

While these developments are expected to have a meaningful impact on deal making, especially with financial sponsors within the mid-market in Canada, it is not certain whether this will bolster M&A activity in the remainder of 2024.

Creativity in M&A

There remains a valuation gap in the M&A market between what a seller expects and what a buyer is willing to pay for an asset. Accordingly, we have observed an increase in the utilization of creative tools and alternative solutions and strategies adopted by transaction participants to bridge the gap in valuation expectations and to address debt funding challenges.

- Preferred and Hybrid Equity Instruments: There has been a significant increase in the use of preferred, hybrid equity, and convertible instruments as forms of equity financing. These provide investors with a preferential capped return on their investment. Market practices for preferred equity, in particular, have been highly transaction and structure-specific, with many instruments emulating the preferential nature (including priority in liquidation) and fixed-maturity of debt instruments while retaining basic equity characteristics to ensure they are classified as equity by rating agencies.

Tax considerations will also inevitably be a key consideration when drafting the terms of the preferred equity, as preferred shares issued by Canadian companies may, depending on their terms and the circumstances of the issuer, result in potential tax liability for the issuer (in addition to any withholding taxes otherwise payable by a non-Canadian investor on any dividends or deemed dividends received on the preferred shares).

- Corporate Carve-Outs: We have observed a rise in corporate carve-out transactions, where buyers seek to acquire specific business lines or assets of larger conglomerates rather than pursuing whole company acquisitions. Similarly, the current economic landscape has prompted many corporations to reassess their strategies and non-core assets, presenting prime bolt-on acquisition opportunities for sponsors and corporates looking to leverage potential synergies with their existing portfolios and businesses.

However, the carve-out process can be complex, as parties must carefully identify the in-scope and out-of-scope assets and liabilities of the divested business and whether transitional arrangements, such as a transitional services agreement, will be required post-closing for continuity purposes. From a tax and financial perspective, the preparation of carve-out financial statements is critical for a buyer, especially if none are currently available for the divested business or if the consolidated financial statements lack sufficient clarity.

- Purchase Price Adjustments: Purchase price adjustments have always been a focal point of negotiations in M&A transactions, but recently we have observed a notable rise in the scrutiny of these provisions and their definitions, with an increased focus on formal dispute resolution.

Earlier this year the Delaware Court of Chancery upheld an arbitrator’s decision that required the seller of Save Mart Supermarkets to pay private equity buyer Kingswood Capital Management more than double the original purchase price due to a customary post-closing purchase price adjustment. The conflict originated from a technical reading of the term “Closing Date Indebtedness,” in connection with the treatment of indebtedness related to a joint venture in which the target company had an interest. This dispute serves as a critical reminder for Canadian companies engaged in M&A transactions, both domestically and in the United States, of the importance of carefully scrutinizing all financial-related definitions and their accounting implications in these transactions, as well as selecting an appropriate forum for resolving purchase price adjustment disputes.

A Focus on RWI

As mentioned in our Q1 2024 Canadian M&A Update, we have seen a rise in the use of RWI, driven by reduced policy retentions and lower premiums. Buyer familiarity and sophistication has increased in RWI which has impacted the M&A landscape in Canada. This trend is continuing into 2024 and is especially notable in the energy and mining sectors in M&A transactions.

Despite a dip in global M&A activity last year due to geopolitical and economic factors, transactional risk claims reached new heights both in number and in terms of aggregate claim payments, according to Marsh McLennan.

The first quarter of 2024 set new records for transactional insurance leaders according to Euclid Transactional. April and May also saw record-breaking numbers for RWI policies, with May ranking as the second-highest monthly total ever. By the end of 2024, a Woodruff Sawyer analysis shows an estimated 75 percent of private equity transactions and 64 percent of larger strategic acquirers using RWI for deal protection.

RWI has now also become a common feature in both private and public M&A transactions, including auction processes and take-private transactions. It typically serves as the buyer’s sole recourse for any breaches of representations or warranties in the definitive transaction agreement by the company or its securityholders. According to a United States study, over 50 percent of transactions involving RWI in 2023 were private transactions, where RWI helped to streamline the negotiations of the transaction documents and eliminate disputes over indemnification mechanics and holdback thresholds.

We have also noted a recent increase in RWI usage in take-private transactions which involves a number of unique considerations, including the minimal recourse structure and lack of post-closing indemnities, in public transactions. While these take-private transactions have historically not utilized RWI at the same frequency as private transactions, in recent years we have noted that insurers are becoming more comfortable with the take-private structure. Accordingly, with the proper planning and legal considerations, RWI insurance has become a viable option for take-private transactions.

RWI in the Energy Industry

The Canadian energy industry is experiencing a notable increase in RWI usage. According to Aon's latest Global Claims Study, energy companies are nearly twice as likely as those in other industries to report breaches related to asset condition representations, which RWI can often help address. Gallagher suggests this trend may stem from pollution and asset condition/sufficiency now being standard concerns in the energy sector.

Increase in RWI Claims

Historically, RWI claims were considered to have a low frequency but high severity profile, however, we have noted an increase in RWI claims in 2023 and 2024. This increase in the number of claims has resulted in parties engaging legal counsel throughout the RWI claim process to ensure that the policy and coverage are maximized.

The Marsh Global Transactional Risk Insurance Claims Report 2024 noted that in 2023 there was a notable increase both in the frequency and severity of RWI claims, particularly in North America, that amounted to $240 million in payments from R&W insurers. At the same time, there was also a significant increase in the number of claims both notified and paid in 2023 and 2024 to date.

Looking Ahead

Q3 2024 saw some much-awaited firsts in the M&A market. The effects of lower interest rates in both Canada and the U.S will take some time to be felt—but the cost of borrowing is clearly going in the right direction. Dealmakers will continue to show their creativity as they address the ongoing challenges of the valuation gap and risk. And the final three months of the year will tell us if the momentum in deal volume continues. But all in all, the conditions for increased M&A activity in Canada improved in the third quarter of 2024.

Bennett Jones M&A Practice

Bennett Jones' Mergers & Acquisitions practice spans all industries—particularly those that drive the Quebec and Canadian economies. To discuss the developments and opportunities shaping the M&A landscape, please contact the authors.

Authors

Kevin Myson

403.298.3049

mysonk@bennettjones.com

|

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs.

For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com.

|