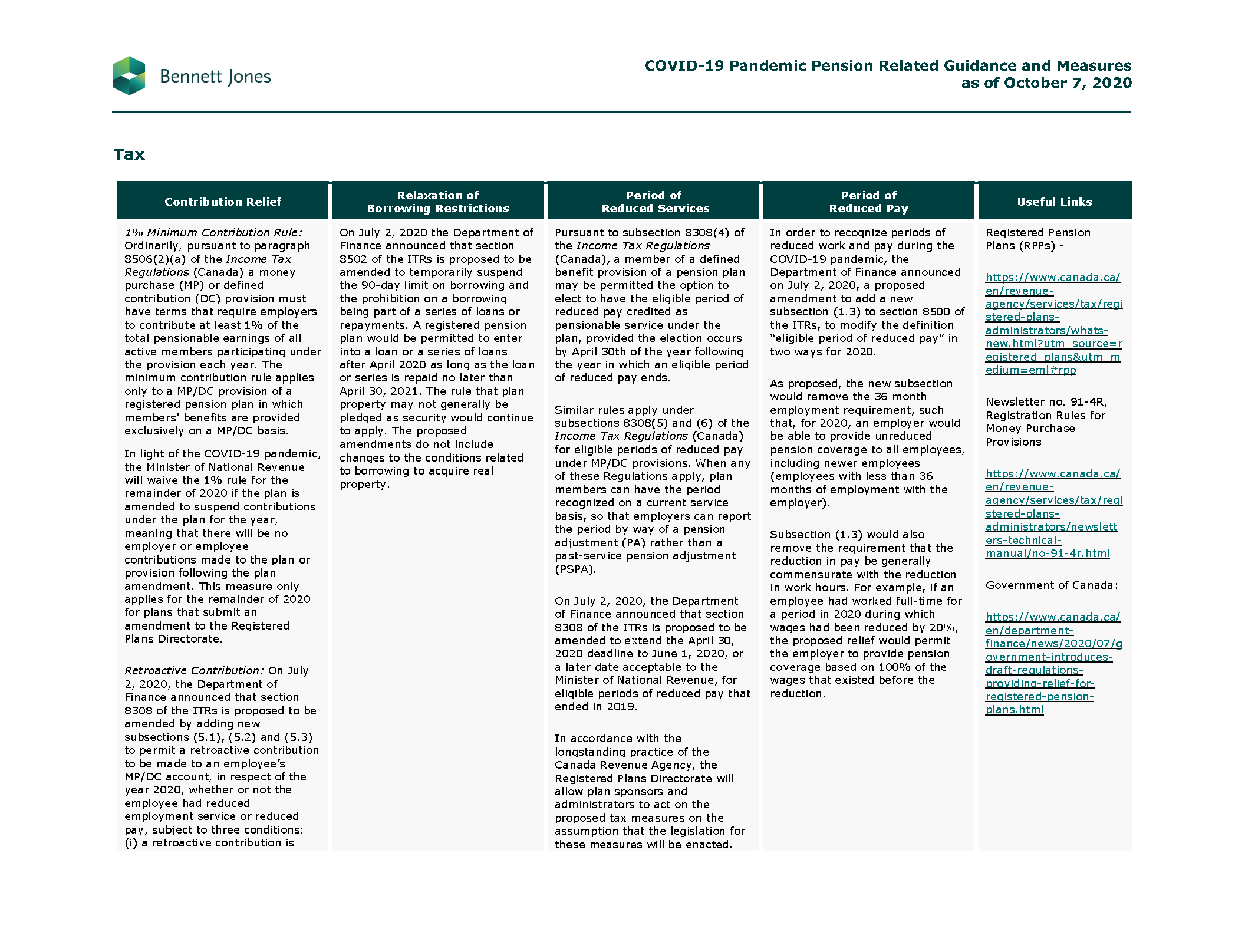

Pension Regulatory Guidance and Measures Related to COVID-19 Pandemic (Updated)In response to the recent market declines and interruptions to businesses amid the COVID-19 pandemic, federal and provincial pension regulators have announced measures to provide relief to sponsors and administrators of registered pension plans and to protect member benefits, including relief from solvency funding requirements, extensions to required filings and disclosures, and measures to limit commuted value transfers. Download this quick reference table which provides an overview of the measures announced to date. Recent Updates:October 7, 2020: Changes made to Saskatchewan to reflect the modifications made to the freeze on transfers or payments out of defined benefit plans. September 29, 2020: Changes made to Ontario to reflect Regulation 520/20 filed under the Pension Benefits Act (amending Regulation 909) which provides funding relief to pension plans, and Regulation 521/20 filed under the Pension Benefits Act (amending Regulation 365/17: Administrative Penalties) which adds the funding relief provisions to the list of provisions subject to administrative penalties. August 31, 2020: Changes made to Federal to reflect the revisions made to the Directives of the Superintendent pursuant to the Pension Benefits Standards Act, 1985. Effective August 31, 2020, the revisions to the Directives allow for the resumption of portability transfers and annuity purchases relating to defined benefit provisions of pension plans, subject to conditions similar to those in place prior to the portability freeze. July 17, 2020: Changes made to Quebec to reflect temporary relief measures provided pursuant to the provisions of Draft Regulation - Regulation respecting measures related to supplemental pension plans to reduce the consequence of the public health emergency declared on 13 March 2020 due to the COVID-19 pandemic. July 2, 2020: Changes made to add COVID-19 related tax relief measures proposed by the Department of Finance Canada, with respect to Registered Pension Plans. June 26, 2020: Changes made to Alberta with respect to the amendments made to the Employment Pension Plans Regulation which permit, certain exemptions to funding requirements and the use actuarial excess, and the ability to use electronic communication for certain documents. June 22, 2020: Changes made to Ontario with respect to extensions to filing and disclosure requirements. Incorporates COVID-19 pandemic pension related guidance issued by Manitoba. June 5, 2020: Changes made to Alberta requirements respecting timelines for providing executed spousal waiver forms and notices of changes that reduce member-required contributions. June 3, 2020: Changes made to Newfoundland and Labrador with respect to extensions to filings and disclosure requirements. June 1, 2020: Changes made to Federal to provide further information on Defined Benefit Funding Relief. May 25, 2020: Changes made to Ontario to provide further information on the extensions to filing and disclosure requirements and commuted value transfers/restrictions on transfers. May 21, 2020: Changes made to Quebec to provide further information on the extensions to filing and disclosure requirements and commuted value transfers/restrictions on transfers. Changes made to New Brunswick with respect to suspension of contributions in a defined contribution pension plan. May 8, 2020: Changes made to Federal with respect to automatic consent to portability transfers under certain conditions. May 7, 2020: Changes made to Saskatchewan with respect to suspension of contributions in a defined contribution pension plan. May 6, 2020: Changes made to Nova Scotia with respect to extensions to filing deadlines for certain documents. May 5, 2020: Changes made to add COVID-19 related tax measures announced by the Canada Revenue Agency, with respect to Registered Pension Plans. May 1, 2020: Changes made to Ontario with respect to Pension Benefits Guarantee Fund assessments. If your business or organization has questions respecting the respect COVID-19 implications to your pension plan, please contact a member of the Bennett Jones Employment Services group. In addition, please visit our COVID-19 Resource Centre for other COVID-19-related materials. Authors

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs. For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com. |

Blog