Written By Brent Kraus, Flutra Kacuri, Sabrina Bandali, Zirjan Derwa and Adam Kalbfleisch

The total number of Canadian M&A deals declined in the second quarter of 2025 as tariff disruption and uncertainty hampered dealmaking activity. However, the overall value of announced Canadian deals was up considerably in the second quarter of 2025, resulting in higher average deal sizes. A similar scenario of fewer deals and higher values is playing out in the United States and globally.

In our latest quarterly update on M&A in Canada, we take a closer look at deal activity, emerging trends in oil and gas transactions, the state of capital markets, the use of tactical M&A to mitigate risk and measures to protect economically significant businesses in Canada.

Q2 2025 Canadian M&A Deal Activity

S&P Capital IQ – US$*

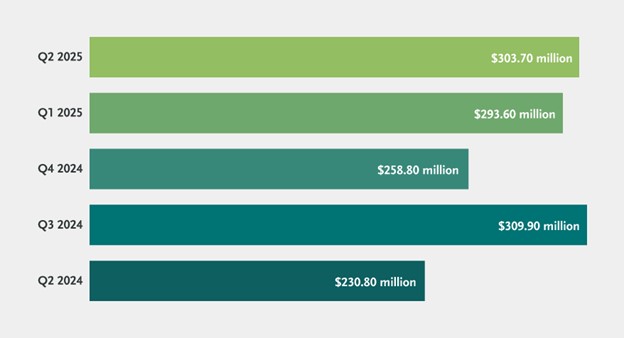

Fewer transactions and larger average deal sizes defined Canadian M&A activity in the second quarter of 2025, according to S&P Capital IQ data. The number of deals declined from the previous quarter, as well as from Q2 of 2024. The number of deals increased during the final quarter of 2024, then dropped rapidly as the effects of volatile tariffs and uncertainty in the markets took hold.

The London Stock Exchange Group (LSEG) also reported a decline in deal volume through the first half of 2025, but reported that the total value of those deals has increased. Global deal value is up more than 28 percent, according to the LSEG.

Average Deal Size

S&P Capital IQ – US$*

The average size of Canadian deals with an announced value in the second quarter of 2025 rose significantly from the same quarter of 2024. There were 21 transactions valued at US$1 billion or more in the most recent quarter, up from 13 in the second quarter of 2024.

For mid-market deals—valued from US$20 million to under US$500 million—total deal value held steady year-over-year while deal count declined. This also resulted in higher average deal sizes within the mid-market segment.

Dealmaking in Oil and Gas

Commodity Price Volatility Provides Challenging Backdrop

Oil prices experienced significant volatility in the first half of 2025. Western Texas Intermediate fell sharply from late 2024 levels, dropping from over US$73.96 per barrel in January to approximately US$59.58 in April, before rebounding to US$75 in June and then declining again by month end. The decline relative to late 2024 levels prompted producers to closely monitor previously approved 2025 capital programs.

Capital Discipline and Balance Sheet Strength

Despite weaker commodity prices, many Canadian oil and gas producers entered 2025 with stronger balance sheets compared to previous cycles, having focused on debt repayment in recent years. Companies continue to prioritize disciplined capital allocation, emphasising shareholder returns, share buybacks and targeted strategic acquisitions. Operational efficiency and cost control remain key themes, supporting free cash flow and return-of-capital targets.

M&A Momentum

In the context of the current macroeconomic environment, M&A activity in the oil and gas sector gained momentum in the first half of the year, with transactions exceeding a billion dollars making headlines once again. In particular, assets in the Montney formation were a focal point of transactional activity, as exemplified by Whitecap Resources’ merger with Veren and ARC Resources’ asset acquisition from Strathcona Resources

In the midstream oil and gas sector, Keyera recently announced a definitive agreement to acquire substantially all of Plains’ Canadian natural gas liquids business, along with select US assets, in a C$5.15 billion all-cash deal. Bennett Jones acted as Canadian counsel to Plains in this transaction.

It remains to be seen whether the targeted M&A of the first half of 2025 is solely the execution of long-term strategies or the start of a broader consolidation trend. Asset consolidations may also result in acquirors divesting other non-core assets as the year progresses. With interest from US private equity regaining traction relative to recent years, there is cause for optimism that transactional activity may bring new capital and market entrants as attention turns to pursuing these opportunities.

Capital Markets

Equity capital markets remained quiet aside from M&A-linked issuances. However, debt markets were more active, with companies taking advantage of improving credit conditions as the Bank of Canada continued to hold interest rates steady following a series of cuts earlier in the year. This financial flexibility may also support deal activity in the second half of the year.

Notably, in June, Canadian Pacific Railway Company, a wholly owned subsidiary of Canadian Pacific Kansas City Limited (CPKC), closed a C$1.4 billion debt offering. Bennett Jones acted for CPKC in this transaction.

Tactical M&A to Mitigate Risk

In the face of trade uncertainty, companies may use M&A tactically in various ways. Manufacturing firms might consolidate buying power or gain control over key inputs in their supply chains. If access to the US market remains restricted by broad tariffs, foreign exporters may face incentives or disincentives to sell to the United States, creating supply constraints for some and oversupply conditions for others. Strategic acquisitions to secure access to critical raw materials and components can protect supply and allow companies maximum flexibility to leverage free trade agreements or preferential duty relief programs to minimize duty and tariff costs.

While one stated aim of US tariff policy is to bring manufacturing back to the United States, companies looking to enter or expand their footprint there may face higher costs and uncertainty due to multiple simultaneous trade wars and domestic regulatory overhauls. Rather than expand in the United States, companies may seek to consolidate or grow non-US operations to maintain a stable base from which to serve Canada and other non-US markets.

Canada presents a compelling alternative. Unless the US government changes course, it is unlikely to reestablish low tariff barriers with any country—Canada may be an exception. It benefits from historic proximity to the United States, although the future value of this proximity depends on the economic and security agreement Canada and the United States may enter into this summer. There is also potential for Canada, the United States and Mexico to renegotiate the Canada-US-Mexico Agreement, likely beginning this fall, with the goal of restoring stable North American trade and reliable access to the US market. Canada continues to act in concert with the North Atlantic Treaty Organization, as well as other European and Pacific allies on security matters, while providing companies access to a considerable and growing network of free trade agreements and stable trading relationships.

Faced with volatility in the Untied States, expansion in Canada may provide a tactical advantage for companies seeking access to the rest of the world.

Protecting Economically Important Businesses in Canada

Earlier this year, the Canadian government announced significant changes to its foreign investment policy. Notably, the March 5, 2025 update states that the government may invoke the national security provisions of the Investment Canada Act (ICA) to prevent “opportunistic or predatory investment behaviour by non-Canadians.” The government also revised the national security guidelines under the ICA to consider the potential impact of an investment on Canada’s economic security, including enhanced integration with a foreign state or its economy.

Applying the ICA’s national security regime more defensively toward US investors would mark a notable shift from historical practice. In the years preceding 2025, Canadian foreign investment policy increasingly focused on limiting investments from Chinese investors in certain sensitive sectors, such as critical minerals.

While it remains uncertain whether the Canadian government will use the national security regime to scrutinize US investors, this development highlights the importance for businesses to factor these evolving policies into strategic transaction planning—particularly for investments by US investors in large Canadian companies.

Looking Ahead

The Canadian M&A market at mid-2025 is not quite where many dealmakers expected. However, the outlook is not all negative. While the number of deals is declining, total deal value is rising. Opportunities remain in select sectors, and buyers continue to show confidence in their long-term plans. Where there is strategic alignment, there is a willingness to transact. Although uncertainty has delayed some activity, M&A typically rebounds strongly when conditions improve.

Bennett Jones M&A Practice

Bennett Jones' Mergers & Acquisitions practice spans all industries—particularly those that drive the Canadian economy. To discuss the developments and opportunities shaping the M&A landscape, please contact the authors.

* All numbers are according to S&P Capital IQ data in US dollars for announced, closed or pending deals—where a Canadian company is the acquirer, target or seller—as of June 30, 2025.

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs.

For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com.